Intraday Craziness Helps to Define the Downtrend

May 02, 2024

The Markets at a Glance

Today's (5/1) action in the market following the Fed's public statements was almost comical, demonstrating once again that traders may be quick on the draw, but they don't always get it right. For some reason, Powell's statements acknowledging the stubbornness of inflation and the Fed's intention, therefore, to hold interest rates where they are for the foreseeable future created a buying spike that shot SPY from near 500 to more than 508 in a flash, only to see it completely retrace that move over the next several minutes.

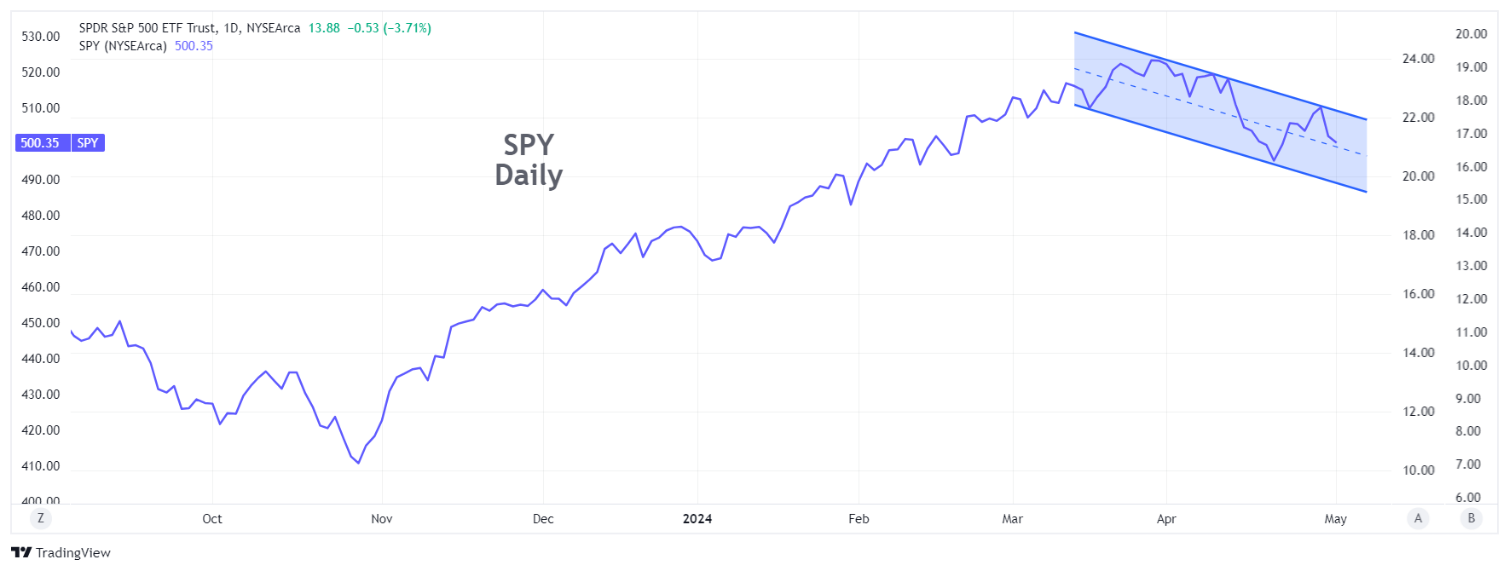

All of this directional confusion was even more surprising, considering the Fed's comments were widely expected and were repeated numerous times in media commentaries over the last two weeks. Indeed, that story may well have been the primary reason why the SPY fell from the 520s to below 494 already in April. What made today's move particularly interesting to a chart watcher is that it brought the SPY right up to the downtrend line that you can see in the SPY chart above, where it promptly retreated. So, while it may have just looked like intraday craziness, it supports the case for the month-long downtrend in SPY to continue.

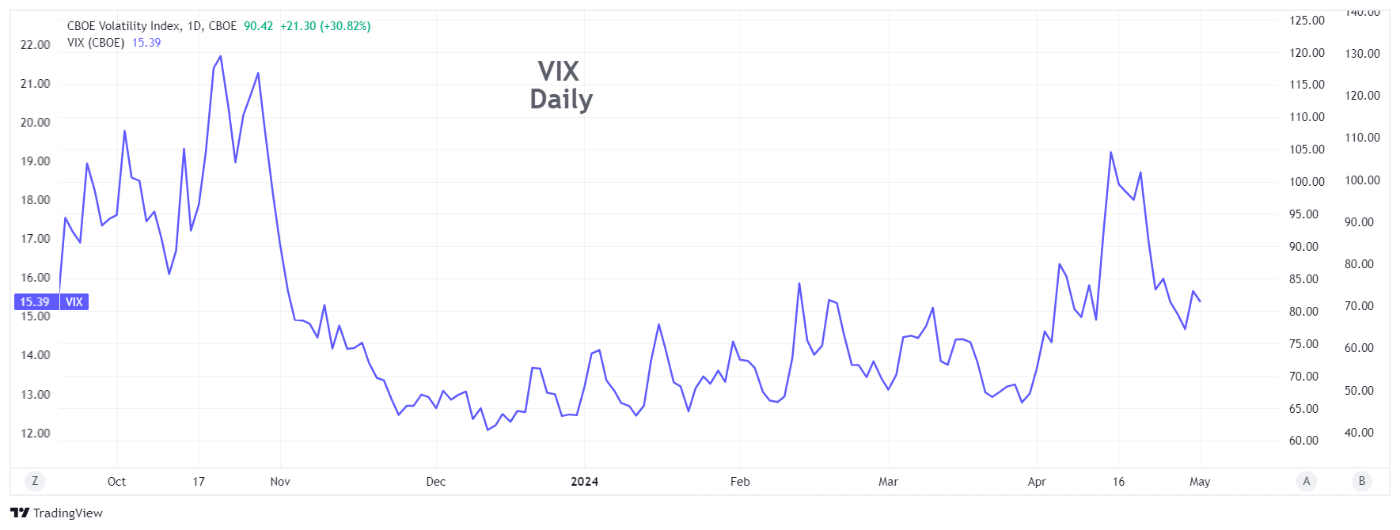

During all this, VIX has backed off from its recent peak above 19, suggesting that while there is some disappointment that the Fed is not going to lower rates in the coming months, investors (institutions in particular) are not running to protect their portfolios with long puts and today's confirmation by the Fed did little to generate much fear on the downside.

To me, this means continued weakness and defensive option strategies for the near term, with surprises (from earnings or the world stage) still likely to bring on more downside. As with most corrections, the markets will need to reprice themselves to a point that once again appears to represent a bargain in order to get buyers to start the ball rolling again on the upside. From the charts, I would expect that another low, perhaps in the 470-480 range on SPY is in the cards before the move ends.

As a follow-up to previously mentioned strategies, bearish (or simply non-bullish) strategies on SPY are still in order and the downtrend line across the peaks of the last month provides a good place to exit those strategies if it is exceeded on the upside. Otherwise, I would hold on to bearish strategies, looking to exit on the next decline toward 470-480 on SPY, particularly if that decline is coincident with a spike in VIX toward 19-20 or above.

Paramount (PARA) remains in play, despite a whirlwind of events and press coverage this week surrounding the CEO's departure and the suggestion that the Redstones will pursue a deal with Skydance for the company rather than take the more lucrative offer from Apollo Group and Sony. Despite yesterday's dip to 11.50 or so on the stock, there was a good rebound today and covered writes at 12 or 12.5 expiring Friday could well provide nice gains for the short time invested. Beyond Friday, however, things are questionable, as the Skydance proposal requires an answer by that day. Given the latest uncertainties and the CEO's ouster (presumably for opposing the Skydance deal), I would exit long positions in PARA unless the successive calls offer a highly compelling return for the next few weeks.

Strategy talk: Put Spread Collars

The put spread collar is a strategy many traders might scoff at because it isn't a short-term trading strategy. But for larger positions that are intended to be held for longer times as core holdings, the strategy enables you to hold on to a stock rather than have to sell it when the market runs through a corrective cycle like it is now. It also allows you to put on a stock position with relative confidence, even when market conditions are questionable.

The simplest collar strategy involves long stock, long put, and a short call, with both options in the same expiration. Using Paypal (PYPL) as an example with May options, a simple collar could be as follows:

PYPL (66.14)

Short PYPL May 70call (.57)

Long PYPL May 63 put (.62)

Net cost: 66.19

The strikes can be adjusted up or down as deemed appropriate to allow more or less upside or downside. In principle, the cost of the put protection is offset by the call premium taken in, so the position has downside protection that did not require additional capital.

A modified version of the simple collar will sometimes use a longer-dated put, with the idea that it will not lose as much time premium per day and that several calls can be written during the life of the put.

I like a version that offers even more flexibility and will generally yield higher returns. It replaces the long put with a bear put spread. There are several advantages to using the spread rather than a long put alone:

• Taking in additional premium from a lower strike put reduces the cost of the strategy and that cost reduction will lead to higher returns in all scenarios except the one where the stock drops below the strike of the lower put in the spread, where additional loss will thus be realized.

• For the same cost, the spread offers downside protection from a higher price point on the stock.

• The long put protects the stock all the way to zero, but you may not desire that much protection, so why not sell off the protection below a certain price that you don't feel you need.

A put spread collar for May on PYPL might look like this:

Long PYPL (66.14)

Short PYPL May 70call (.57)

Long PYPL May 65 put (1.24)

Short PYPL May 63 put (.62)

Net cost: 66.19

This, for the same net price, you now have downside protection from 65 to 63 rather than from 62 to zero.

This can also be modified such that the put spread is in a longer duration so that several or more call writes can occur while the put spread continues to offer downside protection.

Disadvantages of the put spread version of a collar include picking up additional downside risk below the lower strike and the fact that the spread will not protect an immediate drop as well as a long put alone.

At the very least, the put spread collar offers ways to build gradual appreciation with reduced downside risk and it can be played weekly on many stocks, offering lots of flexibility to roll with the nature of the correction.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.