Weekly vs. Monthly Call Writes

August 1, 2024

The Markets at a Glance

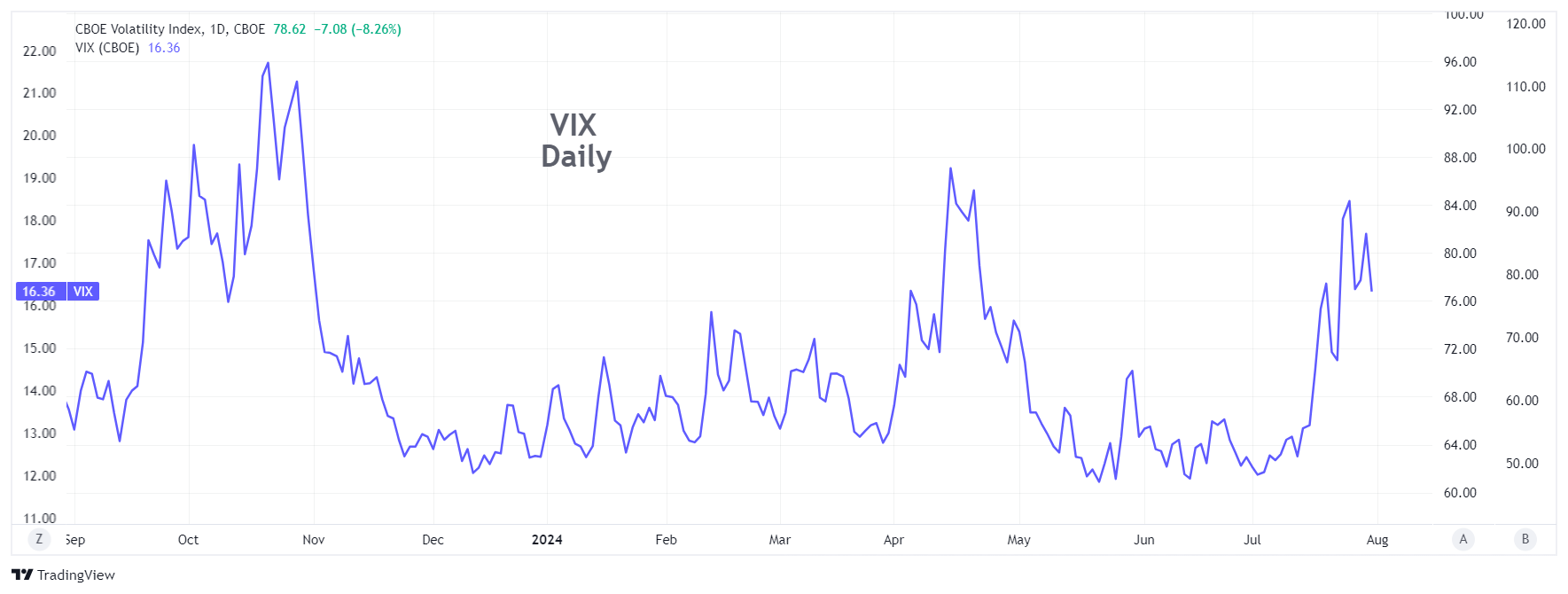

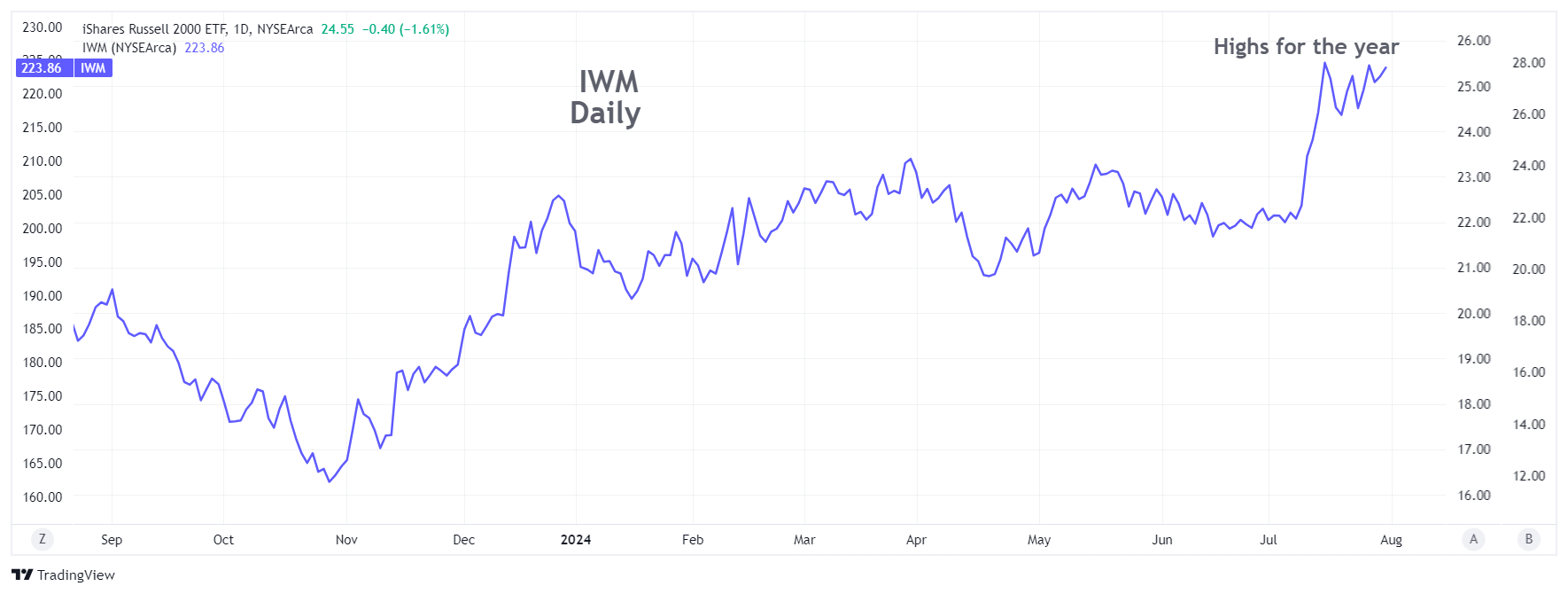

As the SPY and QQQ show signs of breaking their uptrends from last fall and VIX remains elevated in the 16-17 area, the rotation argument is still very much alive. Proof of this can be seen in the RSP (equal weight S&P 500 ETF) which remains clearly still on the upswing and IWM (the Russell 2000 index), which is at its annual highs.

This leaves us with an opportunity to get into some of the issues that have lagged in the upswing this year, as well as to potentially pick up some of the big names that have sold off a bit. On top of that, the extra implied volatility in these stocks may be providing some juicier premiums for call writing.

I am still of the opinion that the upward momentum of the overall equity market is waning here and that moves back to the recent highs may not be in the cards quite so fast, especially at a time of year when doldrums frequently settle in. So, the extra premium in call writes and the recent drops in price look attractive to me. Some of today's mixed performances may be from institutional month-end window dressing, so Friday or Monday may give a better clue as to whether the rotaion will continue or whether the corretion will broaden out.

Strategy talk: Weekly vs. Monthly Call Writes

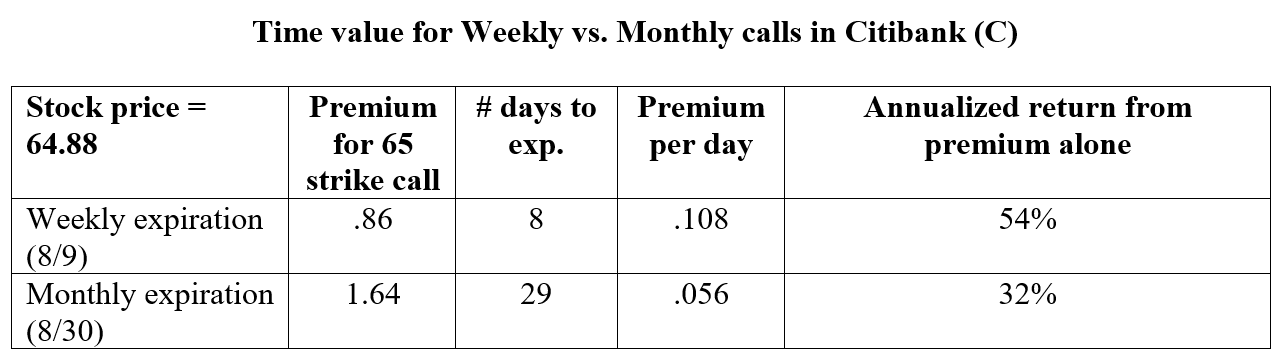

I find this type of market to be just another reason to remain short-term. As such, my favorite durations for writing covered calls are the weeklies. I like the short time horizon for flexibility with rolling opportunities, but it's the additional time premium I get that makes it worthwhile. To illustrate how much more premium you receive for writing weeklies over monthlies, I looked at Citibank (C) stock, which was trading somewhat close to a strike price on today's (Wednesday) close.

There would be a slight additional boost to the annualized return for the monthly if you calculate the return on the lower initial net investment ($63.24 vs. $64.02 for the weekly) but the annualized return for the weekly is still considerably higher.

Once you get accustomed to writing weekly (or sometimes even only for a few days), a month will seem like an eternity and 2-3 months will seem like the next century. It is more work, but the performance advantage of being on the fast part of the premium decay curve can be really invigorating.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.