All Eyes on Volatility

August 8, 2024

The Markets at a Glance

This past week, the market reminded us what it can do when investors get complacent for months and then everyone gets spooked at the same time. Equities had been rolling along on a boost from AI stocks while assuming a perfect "soft landing" for the economy, as the Fed kept interest rates high to fight off inflation. All it took was one surprise from the economic front regarding jobs and suddenly the soft landing scenario gave way to the threat of a recession, which most people had long since forgotten about.

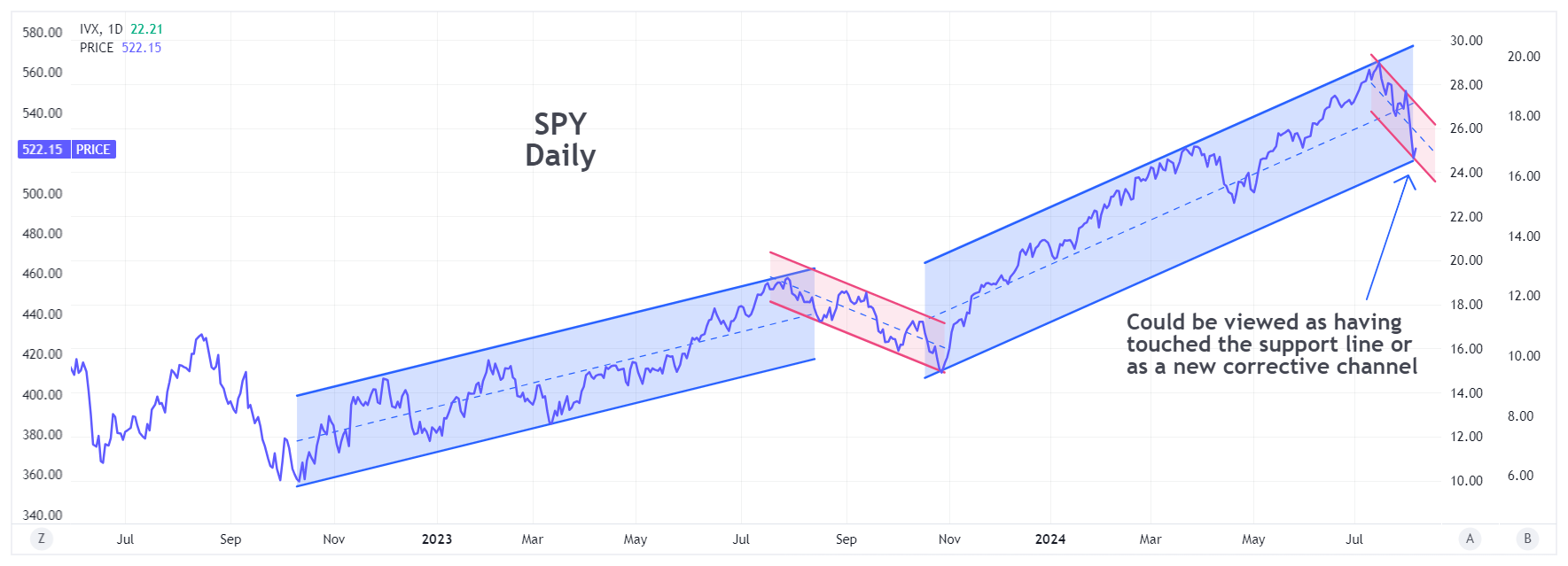

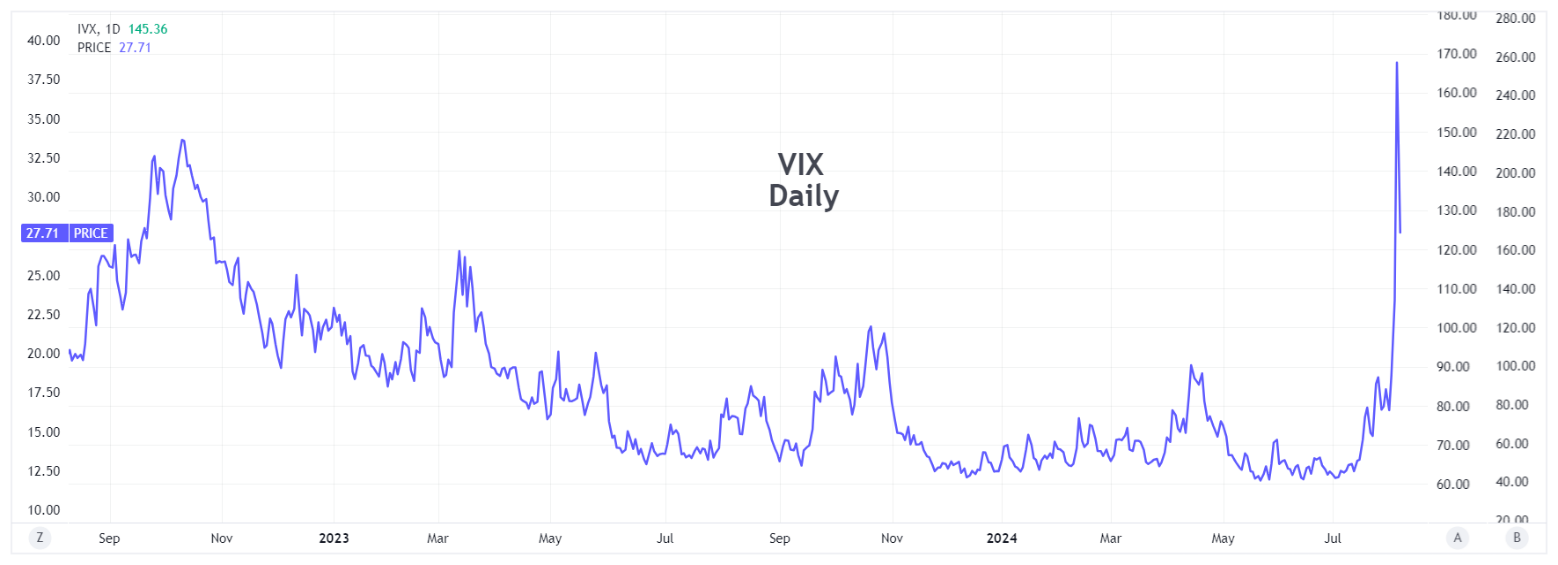

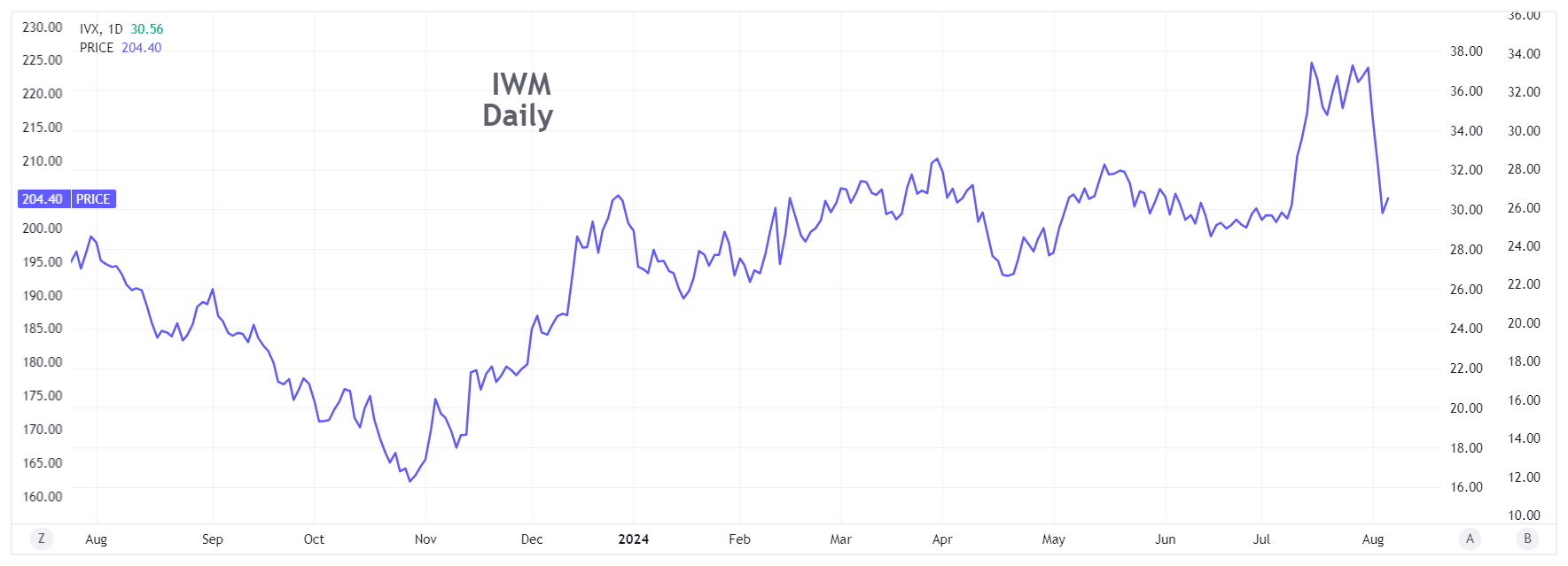

Equities gave back three months of gains in a week and implied volatility skyrocketed to levels not seen in years. And from the coincident drop in IWM, we can also no longer rely on the idea that this is just a rotation from large caps to small caps. The speed and depth of this decline suggest that the correction is broad and somewhat all-inclusive.

So now what?

Since it was economic numbers that spooked the markets, the focus will likely remain on those numbers to see whether they persist. Meanwhile, eyes will also be on the Fed to lower interest rates in September, possibly by a half point rather than just a quarter. I expect that will buy some time for the market to level out soon and for volatility to come back down to a more normal level.

What level would that be and by when?

There is, of course, no magic formula for predicting precise future movements in the markets. However, I have found that technical analysis can at least offer some possible parameters. If you follow Elliott Wave Theory, for example, you would expect this decline to take on a 5-wave formation to the downside before stabilizing and heading up again. Thus far, we can see a clear 4 waves completed, with the fifth currently in progress. That could potentially provide a trading bottom at or below the prior bottom (510 on SPY) in a matter of days.

More importantly, however, while we cannot know exactly where this correction will bottom, we do know that implied volatility cannot sustain itself at these levels. VIX had been near 11 before this move and jumped to over 46 on an intraday basis. It is now back in the high 20s and thus remains quite elevated.

From an options perspective, volatility should be the main focus now of option strategy.

Strategy talk: All Eyes on Volatility

Implied volatility is based on what market participants are willing to pay for options. And the primary driver of elevated IV is the demand for put options, largely from institutions. When the market sells off, it is more practical for institutions to protect their assets by buying puts than by selling stocks. (It may not be the most effective way to protect their holdings, but this is what they do, nevertheless.)

Mass purchases of put options on the SPY are thus what send VIX to such heights. But the prices paid during a panic are not sustainable. A market index can stay low if buyers do not emerge, but IV cannot remain high, as market players will simply not continue to purchase options at such elevated prices. This can easily be seen on charts of IV that show upward "spikes" like we have just witnessed. It is plain to see that these spikes tend to fall back quickly rather than persist at such high levels.

Furthermore, no matter how pricey an option gets, it will lose all its time value at expiration. Therefore, extraordinarily high volatility presents an opportunity for option players. And the primary way to capitalize on this opportunity is by writing the options.

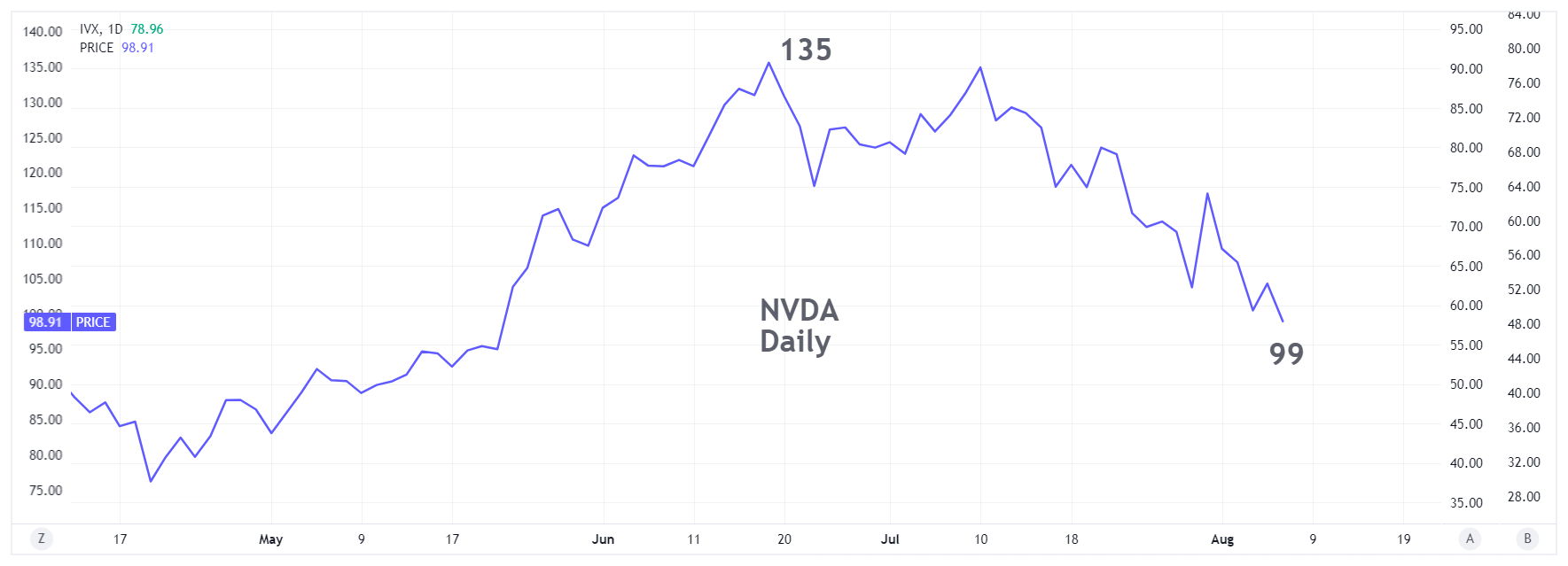

Take Nvidia (NVDA), for example. Here is the chart:

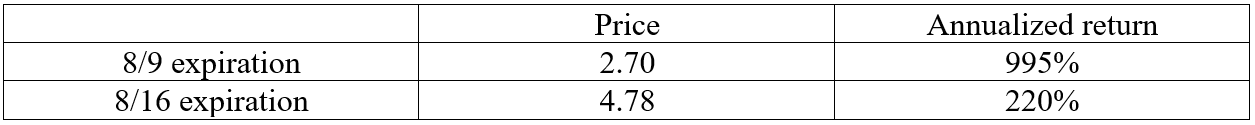

The 99 call options for 1 day and 8 days are as follows:

If you buy NVDA here with no options, you could certainly have a 3-5 point day, but that could be down as well as up unless you are perfect at picking bottoms. With the covered call, you get almost 3 points on any upward move and that also offsets a possible downward move as well.

And don't forget that if you sell the put at the same strike instead of writing a covered call, you get an even greater return, since you would put up a lot less capital.

For option players, high IV represents a rare opportunity. Take advantage of it.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.