Abnormal Times – Abnormal Strategies

April 10, 2025

The Markets at a Glance

Wednesday was another historic day. We've now had several in the last couple of weeks that have exhibited the kind of rare performances that make it into the history books. The gain on Wednesday for the S&P 500 will be somewhere in the top 10 daily gains of all time for stocks.

That may or may not even be good news, depending on whether you made money or were frantically short covering. Looking at the chart above, you can also see how yesterday's move hasn't even recovered half the loss since the last peak.

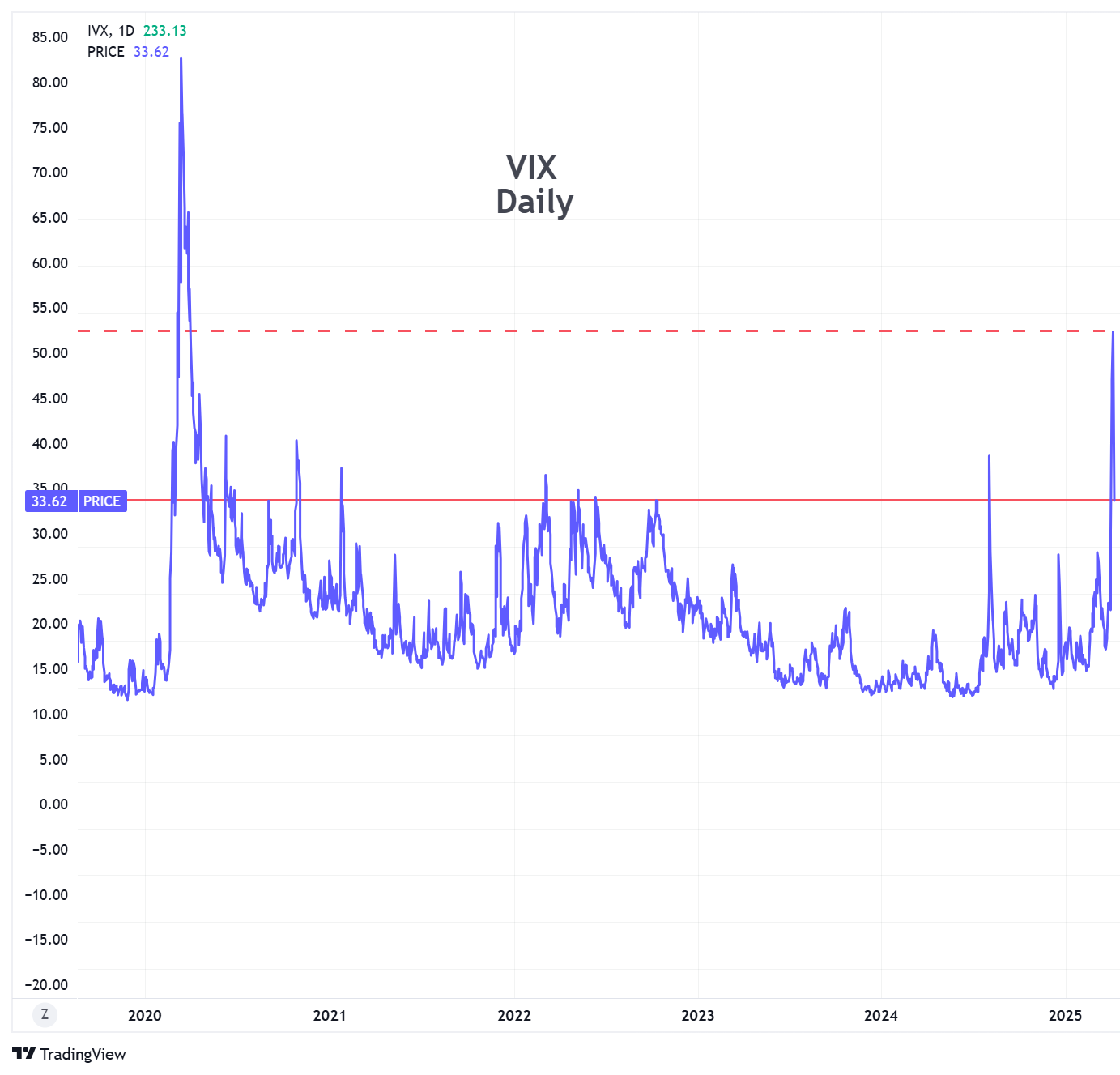

Meanwhile the volatility has also been far above the 'normal' level as well, surpassing 50 just yesterday (a 5-year high as you can see from the chart) and remaining above 30 even after yesterday's recovery (still higher than all but a few readings in that same period). That means we remain in an environment of exceptionally high volatility – high enough for option traders to consider their strategies very carefully.

One thing every successful option trader I have either known or read about has echoed is that success depends upon a trader's ability to recognize when the environment has changed and to adjust their strategy accordingly. I believe that is directly relevant to what was happening in the market these days.

The markets have been demonstrating out-of-the ordinary behavior for the past few weeks, creating a trading environment that is clearly extreme in volatility and subject to head-turning intraday reversals. This is the kind of market behavior that occurs when there is a major exogenous influence and has occurred only in rare instances such as 2020 (Covid shutdown), 2008 (Real estate crisis), 2000 (Internet bubble), and 2001 (9/11 events).

As a result, the most important thing for option traders right now is to keep a cool head and adjust their strategies to the current environment.

How long might that be? No one can tell you exactly, but I see the nature of yesterday's environment as similar to times in the past when economic conditions were making a significant shift like 2022 and 2008, rather than one-time events like the World Trade Center in 2001 or the initial Covid scare in 2020. The one-time events can recover somewhat quickly, while the weak economic periods tend to take months to play out.

So, for perspective on how the remainder of the 2025 market might unfold, I am looking at 2022. In that year, the market was heading lower right from the start of the year. Inflation was rising, the yield curve had inverted, GDP was shrinking in the US and Europe, and there was talk of a possible recession. To add fuel to the fire, Russia invaded Ukraine. The market had six major down legs that year and six up legs, ending the year down 25%. Each leg was a 5-20% move in itself.

We actually have much of the same type of economic environment today (even without the tariff squabbles). Inflation is up, GDP is weakening (expected to be -2.8% for Q1), recession is in the air, and the war in Ukraine still rages as does fighting in the middle east. And on top of all that, we have a newly elected government that has exhibited a penchant for shaking things up in numerous areas of our lives, businesses, academia, and government while readily acknowledging that there will "be some pain" in the interim.

To me, it is like having so much pain in your knee or hip that you cannot walk, so the doctor recommends surgery. You focus on the fact that surgery will enable you to walk pain-free again and you go ahead with it. But after the operation, you have months of new pain and rehab work before you are all healed. That is the best outcome. Some people will have complications or problems that can linger for years or never fully heal right after such operations.

With all that I mind, I recommend that you try to disassociate yourself from your political view right now and focus on the volatility and the economy. And when you do, I think you will find that whatever you were doing for the past two years probably isn't your optimal strategy for the months ahead.

Bear in mind that there is never one strategy that fits everyone. I will merely offer suggestions in the strategy section below on how I have adjusted. Hopefully it may give you some insight on how to adjust your own strategy.

Strategy Talk: Extreme Volatility

Extreme volatility and very fast markets can be harrowing. Executions are difficult, as market makers open their bid-ask spreads. Intraday reversals are more frequent, requiring you to pay close attention throughout the day, and relationships between different stocks or indexes can get temporarily out of whack.

Options are selling at exorbitant premiums and they will also hold a lot of time premium right up to the closing minutes before expiration. (The other day, I had an IWM call written at the 179 strike and IWM was trading at 178.80. With one minute to go before closing, the expiring 179 call was still selling at $.80-.90. If you want to cover or roll it, that's what you would have to pay to buy it back.)

The biggest change I made strategically was to focus on my holdings in SPY, QQQ, and IWM rather than in individual stocks and to strategize around capturing premium from covered calls rather than playing direction. My rationale is that I have more confidence in what the market will do and where support and resistance will lie than I do for individual stocks. I also feel more comfortable with market dynamics, such as the opening behavior of an index ETF due to index arbitrage. Most importantly, they have daily expirations.

To get my returns from premium rather than direction, I've been writing calls daily and maximizing premium by using ATM strikes or something close, then waiting until the end of the day and rolling to the next day. If the market is tumbling, I may roll down to a lower strike during the day. (I rolled down twice during one big down day.)

Yesterday, SPY closed at 543.54. The 544 call for Thursday was selling at around 5.60 near the close. That's a little more than 1% in premium. My basic rationale is to capture close to that amount each day. If SPY goes up tomorrow, I get 1%. If it goes down, I have 1% protection before I lose money.

If the market rises enough, I may need to take a loss on the option, but I roll for a credit or a small debit and move up a few strikes. Yesterday was a huge up day, so I let the ETFs get called away and will re-enter positions at an opportune time.

If I have a strong feeling the market is vulnerable to the downside, I will roll down in strike and if the market is moving up firmly, I may roll up in strike. But this is very different from writing in a bull market, where you look to make money through appreciation and just supplement that with a little call premium where you can.

Some other pointers for a high-volatility environment:

- When putting on a new position or when rolling, go for a slightly higher price than the current quote midpoint. In a fast-moving market, you will often get that higher price.

- Remember: premium decay is more predictable than stock or market direction.

- Expect the unexpected – especially with a President who likes to make major announcements in the middle of the day via social media.

- Verify big news before acting on it.

- Read news from both political viewpoints in order to reduce bias risk.

- Don't get overconfident about what you think a stock or the market are going to do. The last few days were not something anyone could have predicted.

- Sit out a day if you simply don't feel you understand what the market (or a stock) is doing.

Trade smart!

Note to readers: This will be my last newsletter, as I am spending more and more time on a startup venture. I am handing over the reins to Fauzia Timberlake, a colleague I have known for 10 years and whom I highly regard. While I spend a lot of my time teaching, Fauzia spends all her time trading and coaching other traders. I'm sure you can learn a lot from her.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.