MBS Bonds - Examples of Asymmetric Information in MBS Trading

April 21, 2025

MBS bond trading, like trading in other markets, is fundamentally about the exchange of information. What sets MBS trading apart is the nature of the information being traded. In equity markets, company financial reports are key. In the MBS market, however, the most critical information pertains to the performance of the loans underlying the bonds.

This loan performance information can be classified into three categories:

- What we know

- What we know we don't know

- What we don't know we don't know

Naturally, these categories evolve over time. A newly discovered data field may move from category 3 to category 2 as we become aware of its importance, and eventually to category 1 as it becomes fully understood.

The goal is to trade using the most complete and timely information available. Otherwise, trading occurs under asymmetric information, where one counterparty has more knowledge than the other. In such cases, the more informed party typically has a distinct advantage.

Below are examples from each category, drawn from our trading experience:

- Loan performance data we know

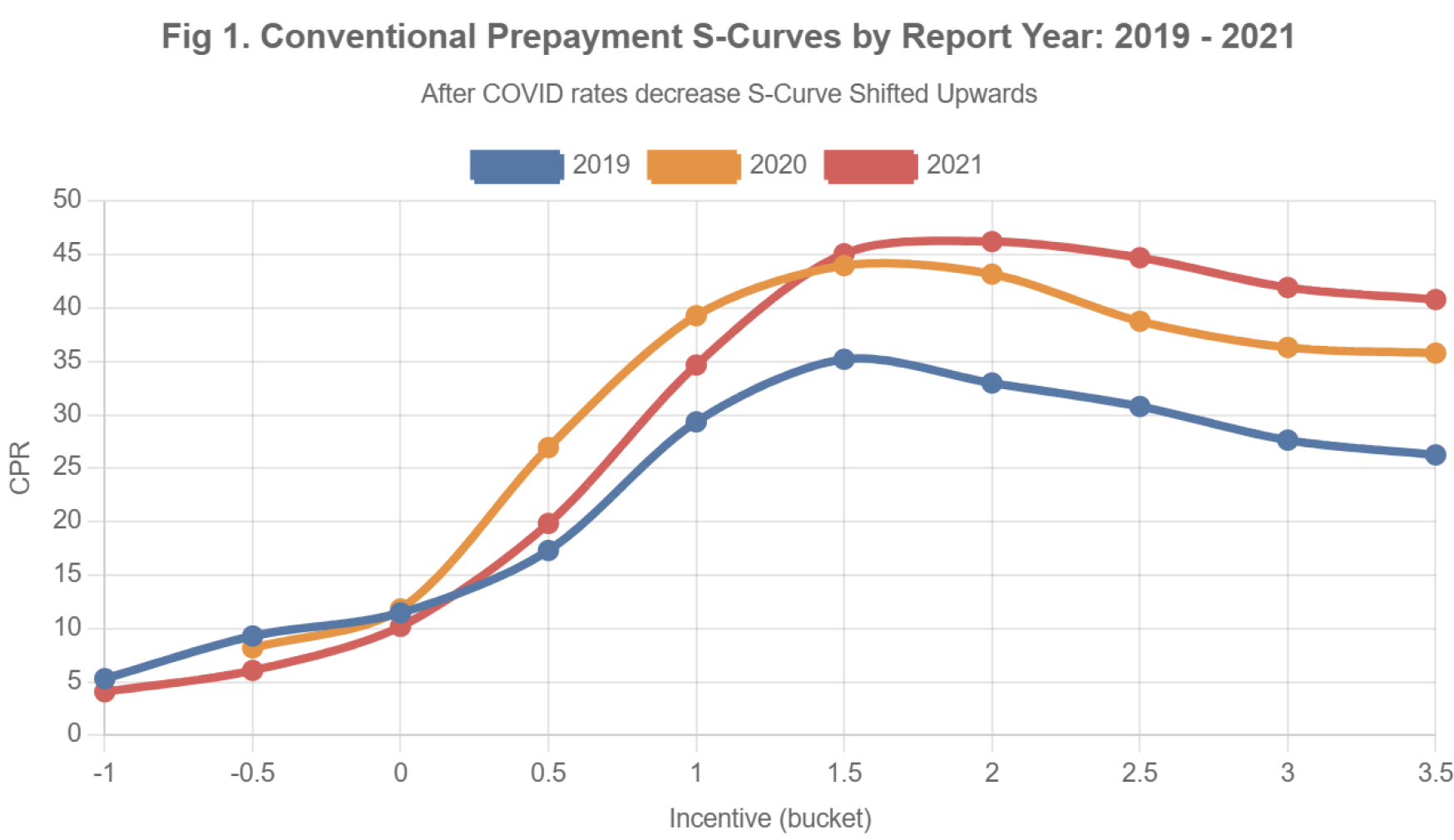

Example: Relationship between prepayments and borrower incentive (S-Curve)

The S-Curve is a well-understood concept and remains foundational in MBS analysis (see Fig. 1). However, it shifts over time and should be monitored monthly. During the COVID-era rate rally, for instance, the S-Curve shifted upward every month resulting in the shift between 2019 to 2020 S-Curve up to 15 CPR (see Fig 1). Popular prepayment models lagged these shifts due to lengthy recalibration cycles (often 3-6 months). As a result, market participants realized that prepayment models were too slow compared to actual speeds. This led to significant widening of OAS spreads in these models – hundreds of basis points for premium MBS pools and thousands of bps for MBS derivatives. In reality, many bonds were trading at negative OAS, once adjusted for the actual S-Curve. This was confirmed by the same prepayment models once they were eventually recalibrated. - Loan performance data we know we don't know

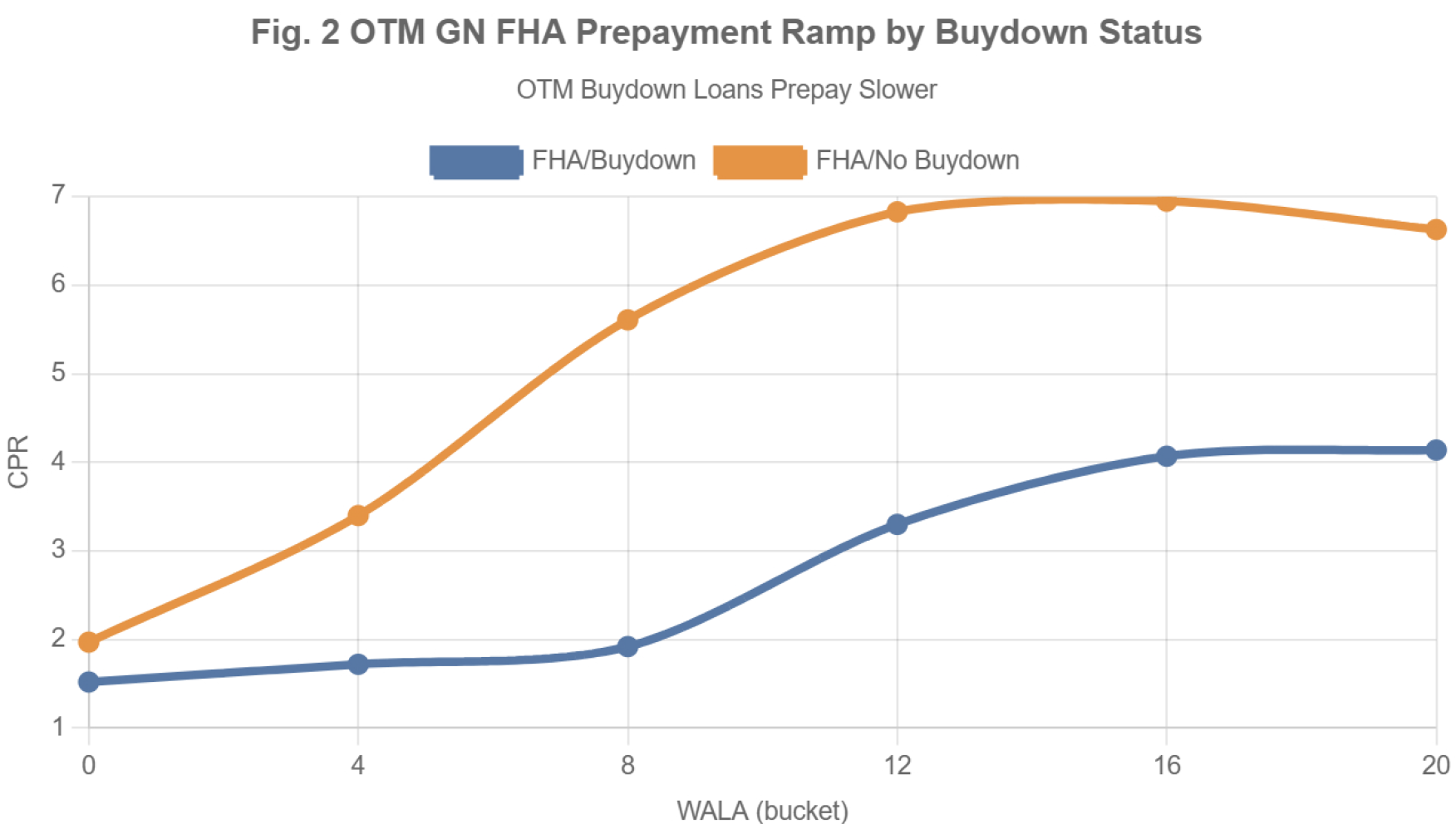

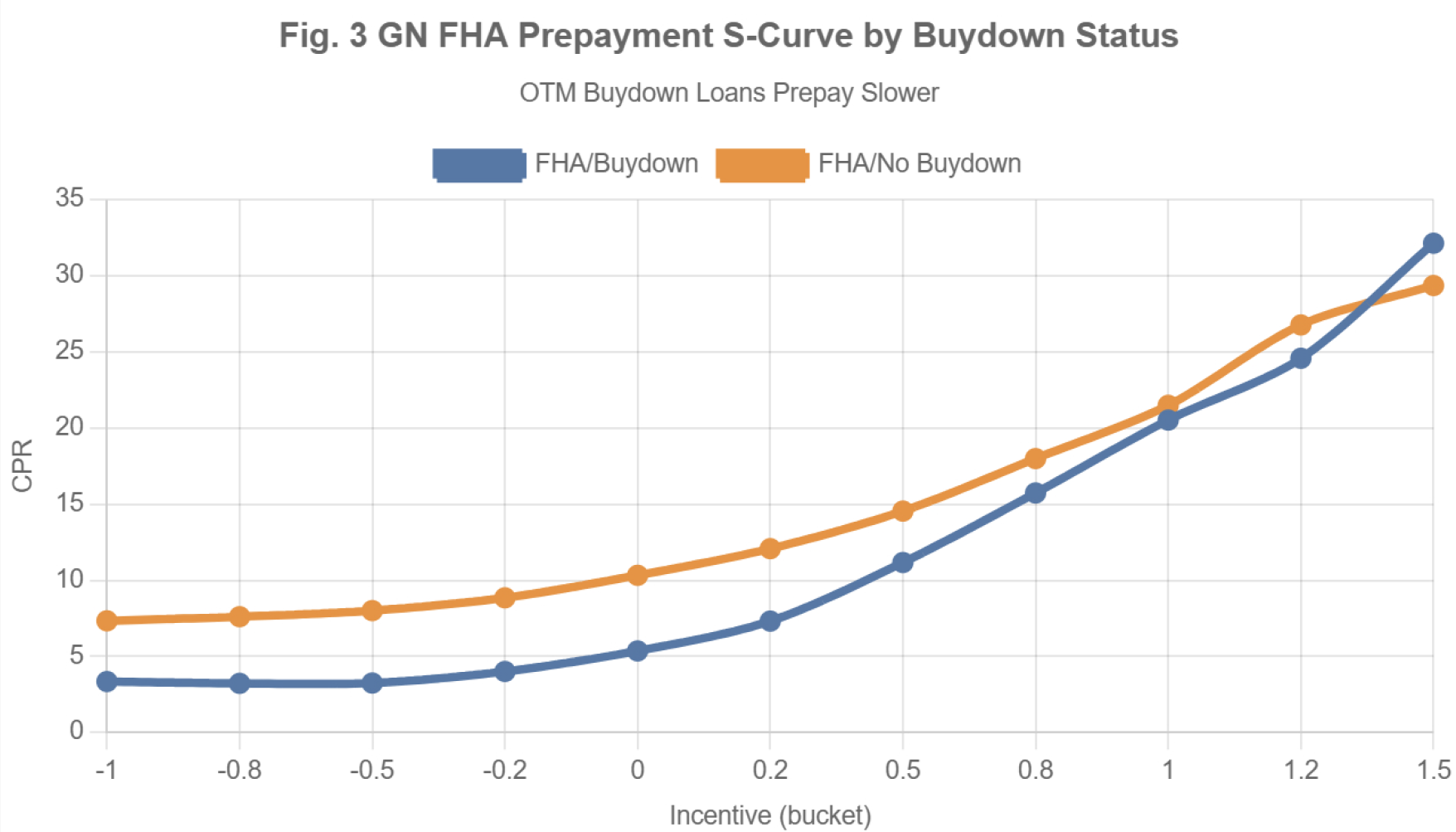

Example: Mortgage rate homebuilder buydowns and their impact on prepayments

Due to stretched housing affordability, homebuilders have increasingly started to offer mortgage buydowns to attract buyers. These buydowns allow borrowers to secure mortgage rates below market. The buydown out-of-the-money (OTM) pools prepay slower compared to non-buydown collateral (see Figs. 2 & 3). This materially affects pricing of buydown collateral bonds: discount pools may be 20-50 bps richer, and IO/IIOs up to 200 bps cheaper. Yet, most production prepayment models do not yet incorporate buydown collateral, and this data is not readily available on platforms like Bloomberg (except in pool distributions) so we know that most prepayments models cannot be used currently for this collateral type. - Loan performance data we don't know we don't know

Example: Cross-linking with non-mortgage loan-level data

We are actively working with non-mortgage loan-level data vendors to identify previously unrecognized factors that may impact mortgage performance. These variables will be incorporated into our No-Model Data-Driven platform.

Is there a silver bullet to mitigate asymmetric information in MBS trading? Yes. The silver bullet is to always let the data speak – ensuring that valuation and risk assessments reflect the most current market conditions and all loan performance data available.

Our No-Model Data-Driven valuation technology automates this process across all structured products, delivering the most accurate and consistent pricing and risk metrics in the industry. Let us know if we can help!

Why Choose Us?

With over 20 years of experience and a proven track record in data and analytics development, IVolatility serves more than 500 institutional clients and 130,000 retail customers. Now, we're bringing this expertise to MBS data and analytics.

Discover the benefits of using IVolatility solutions for Mortgages:

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Please let us know!

Previous issues are located under the News tab on our website.